5 Easy Facts About Offshore Wealth Management Explained

Wiki Article

Our Offshore Wealth Management Diaries

Table of ContentsOffshore Wealth Management - The FactsThe Offshore Wealth Management StatementsGetting The Offshore Wealth Management To WorkThe Of Offshore Wealth ManagementRumored Buzz on Offshore Wealth Management

If you are wanting to offshore financial investments to assist safeguard your assetsor are worried about estate planningit would be sensible to locate a lawyer (or a team of attorneys) concentrating on property security, wills, or company sequence. You require to check out the financial investments themselves and their legal and also tax obligation ramifications - offshore wealth management.The advantages of offshore investing are outweighed by the significant expenses of specialist charges, commissions, as well as travel expenditures.

Jersey is an overseas location with ingrained connections to our impact markets. With wide industry understanding in riches monitoring and monetary structuring, Jacket is regarded as one of one of the most developed and well-regulated offshore economic centres on the planet.

All about Offshore Wealth Management

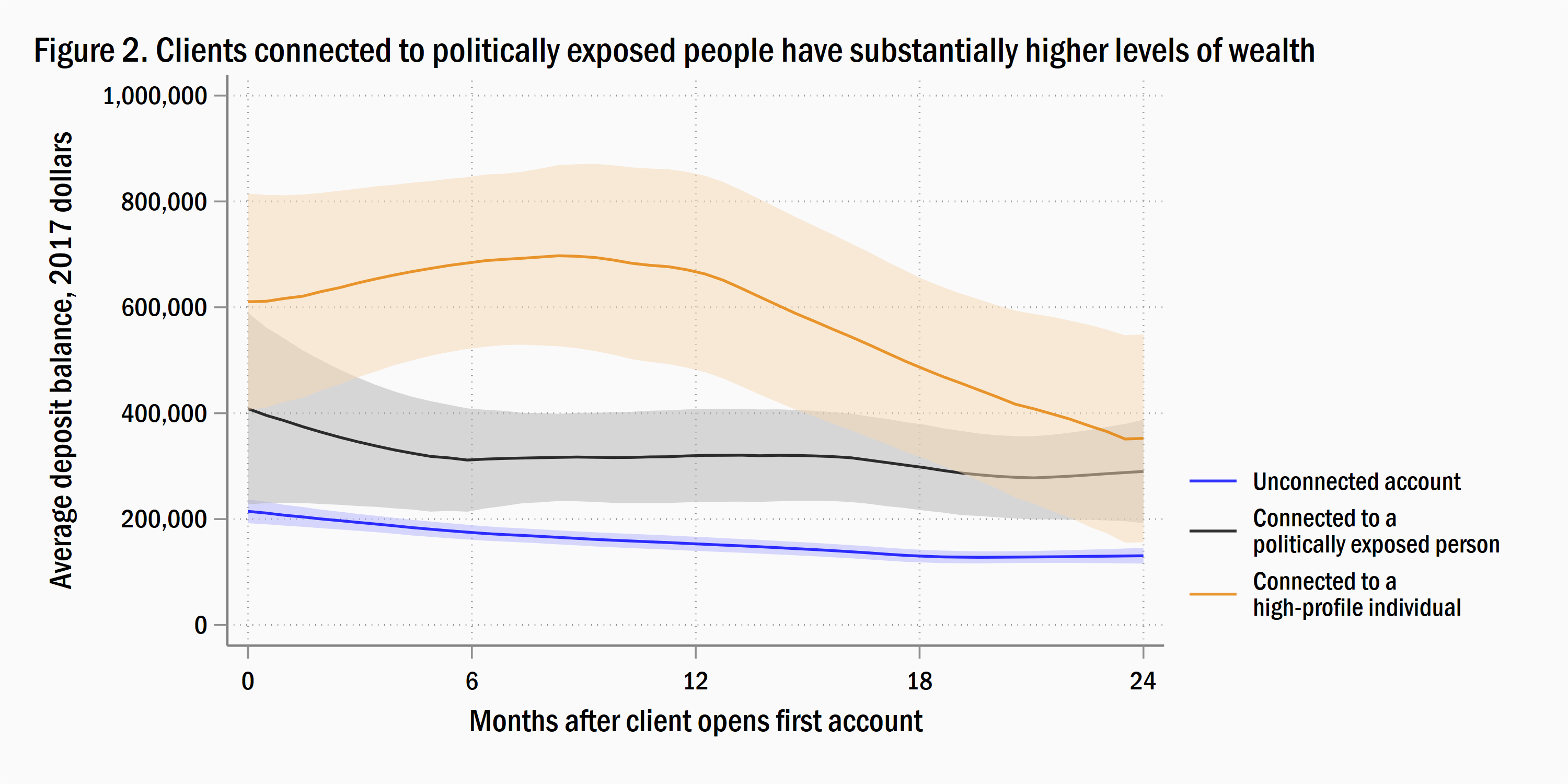

List of Numbers, Number 1: Offshore assets rose early in the pandemic as investors sought safe houses beforehand and after that chose financial investment chances, Figure 2: The tidal bore of non-resident wealth right into Europe is receding, Figure 3: The main roles of New York and London stay even after riches drains from in other places in the areas, Number 4: Asia-Pacific is once more back to driving development in the overseas market, Number 5: Unfavorable macroeconomic 'press' elements are driving the boost in HNW offshore investment, Figure 6: Australian investors who are eager to directly possess a trendy tech supply are being targeting by moomoo, Number 7: Privacy and also tax obligation were mainly missing as motorists for offshoring during the pandemic, Number 8: Financial institutions dramatically raised their hiring for policy and conformity in the early months of 2022Figure 9: Regulation-related work employing from Dec 14, 2021 to March 14, 2022 compared to previous quarter, Figure 10: The North American market is well provisioned with overseas services, Number 11: Currency danger has actually expanded over the last ten years as well as is increased in times of dilemma, Figure 12: The majority of personal riches companies in the United States and also Canada can connect customers to offshore companions, Figure 13: Citibank's offshore investment choices cover multiple possession classes, Figure 14: ESG is equally as crucial as high returns in markets that Requirement Chartered has existence in, Number 15: Standard Chartered's global solution accommodates both fluid and also illiquid overseas financial investments, Figure 16: HSBC Premier India services concentrate on international opportunities as well as NRIs (offshore wealth management).There are lots of, and the complying with are just a couple of examples: -: in lots of countries, bank down payments do not have the very same security as you might have been made use of to in the house. Cyprus, Argentina as well as Greece have actually all provided examples of banking situations. By making use of an offshore bank, based in an extremely managed, clear jurisdiction with statutory protections for financiers, you can feel protected in the expertise that your money is risk-free.

A connection supervisor will certainly constantly supply a personal point of call that should take the time to recognize you and your needs.: as an expat, being able to keep your bank account in one area, no issue the number of times you relocate countries, is a significant benefit. You additionally understand, regardless of where you are in the world, you will certainly have access to your cash.

Some Ideas on Offshore Wealth Management You Should Know

These variety from keeping your money outside the tax obligation web of your house nation, to securing it from tax obligations in the country you're presently residing in. It can published here additionally work when it pertains to Click Here estate planning as, depending upon your race and tax obligation status, properties that sit in your overseas savings account could not undergo inheritance tax.

Spending with an overseas financial institution is straightforward and also there is typically recommendations or devices accessible to help you create a financial investment portfolio appropriate to your risk account and the outcomes you intend to accomplish. Investing with an offshore savings account is typically a lot more flexible and also clear than the alternatives that are traditionally used.

You can take benefit of these advantages by opening up an overseas bank account., like AES International, can open an overseas personal bank account for you within 48 hrs, supplied that all the needs are met.

Excitement About Offshore Wealth Management

Prior to you invest, ensure you really feel comfortable with the level of risk you take. Investments purpose to grow your money, yet they may lose it also.This is being driven by a strong readiness to move in the direction of refinement, based on an approval of international knowledge in terms of items, solutions as well as processes. In India, at the same time, the huge quantity of brand-new wide range being produced is fertile ground for the appropriate offering. In line with these and various other local fads, the definition and range of exclusive banking is transforming in much of these neighborhood markets in addition to it the demand to have accessibility to a wider selection of product or services - offshore wealth management.

An Unbiased View of Offshore Wealth Management

With higher internal expertise, customers are most likely to feel much more sustained. Subsequently, the objective is to grad a bigger share of their wallet. International gamers require to take note of some of the difficulties their equivalents have actually encountered in certain markets, for example India. The bulk of worldwide institutions which have actually set up a company in India have actually tried to follow the same version and design as in their house country.

Report this wiki page